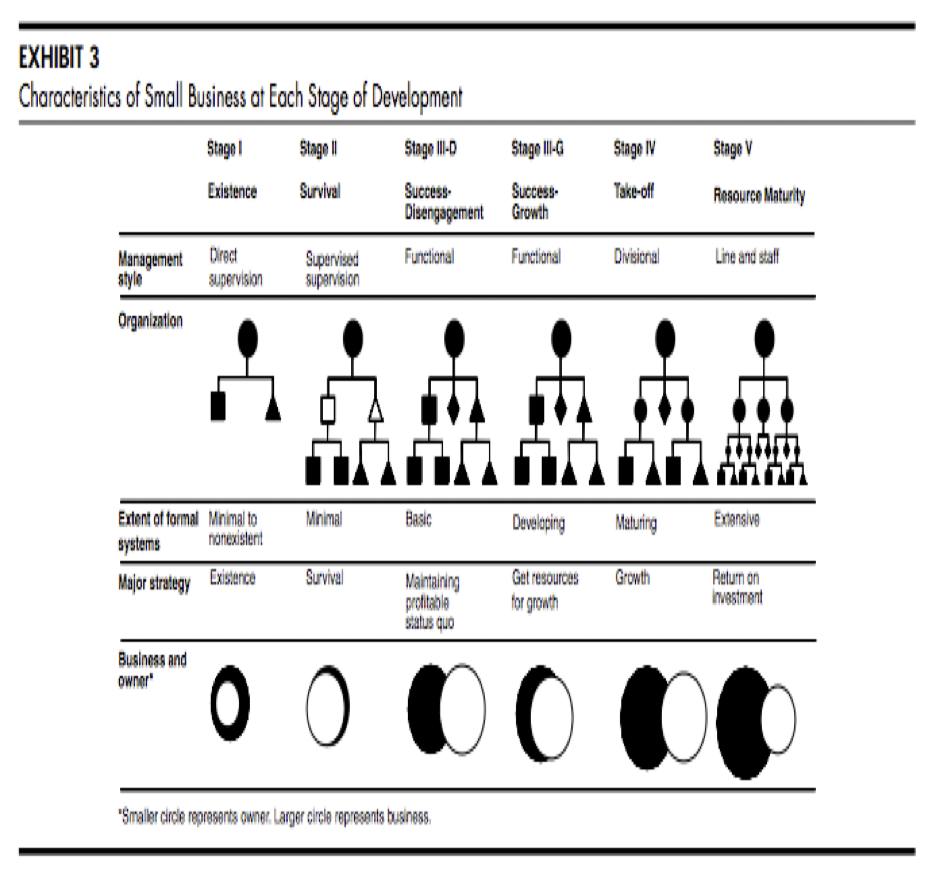

A classic Harvard Business Review study tackled the complex problem of analyzing the issues and growth patterns of small businesses in such a way that it identified the common problems that arise at key stages of small business development. The report integrated relevant small business experience, a thorough literature search, and empirical research to develop a framework for the five key stages of small business growth: Existence, survival, success, take-off, and resource maturity. The following summarizes the key concerns for each stage.

1. Stage I: Existence. In the beginning, small business owners are most concerned about finding and signing up customers and being able to deliver their products and services. They are grappling with the question of whether they will get enough customers and deliver enough products/services to become a viable business; whether they can move from a test/beta/pilot phase to be able to scale; and whether they have the financial resources, cash, to meet all start-up requirements. The companies that move past these issues and remain in business become Stage II companies.

2. Stage II: Survival. At this point, businesses have proven their basic business plan premise and have a true operating concern. The focal point at this stage then is the relationship between revenues and expenses. Owners are evaluating whether one, they can generate enough cash to break even and cover the repair/replacement of basic assets; two, whether they can get to cash flow break-even; and three, whether they are able to finance growth in order to earn an economic return on assets and labor.

3. Stage III: Success. This is a pivotal point for owners in that the business has reached economic health, and the owners are debating whether to leverage the company as a growth platform or consider the company as a means of support for them as they embark on disengaging from the company. Thus, there are two substage tracks to the Success stage.

In the Success-Growth substage, the owner pulls together all resources and risks them to some degree with the intent of financing growth. If this is the direction, they are focused on the basic business staying profitable while the company enters into a parallel strategic planning and execution phase.

In the Success-Disengagement phase, the company should be able to maintain itself indefinitely barring external environmental changes. Managers take over the owner’s operational duties, and the strategy is to essentially maintain a status quo. The owners either benefit from the cash flow from operations “indefinitely” or prepare for sale or a merger.

4. Stage IV: Take-off. Knowing that they are poised for growth, what owners face at this juncture is how to grow quickly and how to finance their growth. Both operational and strategic planning is being actively done, with managers having very real responsibilities. Owners then grapple with structural organizational issues of how to construct the enterprise and how to delegate to these managers, and in what way. In terms of cash, the owner is often faced with having to tolerate a high debt-equity ratio as well as aggressively manage cash flow and expense controls. Failure at this stage often occurs because of the attempt to grow too fast – running out of cash, or not being able to effectively delegate authority to a managerial team.

5. Stage V: Resource Maturity. At this point, the company has the staff and financial resources to engage in detailed operational and strategic planning. It has a decentralized management structure with experienced, senior staff and all necessary systems are in place. The owner and the business have separated to a large degree, both financially and operationally. If the company can continue as it has, and maintain its entrepreneurial spirit, it has a strong probability of continued growth and success – as long as it avoids what the study calls “ossification.” Ossification occurs when innovation stalls and the corporate culture begins to avoid taking risks – both common traits in corporations as they grow. The key is to maintain a nimble culture that pays attention to environmental, and market changes and has the organizational structure and incentives that reward adaptation.